Why Bitcoin Matters & How to Get Started

Bitcoin vs. "Crypto" – A Critical Distinction

Bitcoin (BTC) is the first and only truly decentralized monetary network. Created in 2009 by Satoshi Nakamoto as an alternative to the traditional fiat system, Bitcoin stands apart from the thousands of “crypto” tokens that followed.

Key Distinctions:

✅ No CEO, No Central Authority – Governed by open-source code and a globally distributed network.

✅ Absolute Scarcity – Only 21 million Bitcoin will ever exist, making it immune to inflation.

✅ Security & Stability – Over 15 years of uninterrupted uptime with zero successful hacks.

✅ A Unique Value Proposition – Bitcoin is not a speculative tech startup—it’s the first truly decentralized and non-confiscatable form of digital property.

Most "crypto" projects are centralized, VC-backed ventures prone to failures (e.g., FTX, Luna, Celsius). Bitcoin is not "crypto"—it is digital monetary property.

What Problems Does Bitcoin Solve?

1. Inflation & Currency Devaluation

Central banks print trillions of dollars, eroding your purchasing power. Bitcoin’s fixed supply (21 million coins) ensures scarcity, protecting purchasing power over time.

2. Property Rights & Self-Custody

Bitcoin enables true ownership without intermediaries. You don’t need a bank, government, or institution to hold it. You can store millions of dollars on a hardware wallet the size of a USB stick—secure from seizure.

3. Long-Term Store of Value

Bitcoin has outperformed every other asset over the last decade:

Bitcoin CAGR (10 years): ~44%

S&P 500 CAGR: ~12%

Gold CAGR: ~6%

💡 Fact: No one who has held Bitcoin for at least 4 years has ever lost money.

📊 Source:

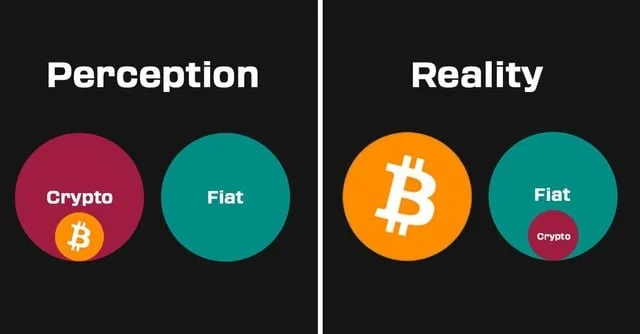

Bitcoin’s Market Dominance

Many people think Bitcoin is just another “crypto” asset. Reality check: Bitcoin dominates the entire industry.

Bitcoin vs. Crypto (including stablecoins): ~61.39% of total market cap (Investopedia)

Bitcoin vs. Crypto (excluding stablecoins): ~67.0% (NYDIG Research)

💡 Key Takeaway: Bitcoin is the dominant asset in the space—not just another "crypto project."

How to Buy Bitcoin

💳 Best Platforms to Buy Bitcoin:

1️⃣ Swan Bitcoin – 1% fees, auto-buy & auto-withdrawal, strong self-custody focus.

2️⃣ River Financial – No fees on recurring buys, instant wire withdrawals, and lightning support.

3️⃣ Strike – Great for Lightning transactions, low fees, supports hourly dollar-cost averaging (DCA).

💡 Pro Tip: Fund your account via wire transfer instead of ACH to withdraw Bitcoin immediately. ACH deposits may require a 30-day wait for withdrawals.

How to Store Bitcoin Safely

1. Single-Signature Wallets (Best for Beginners):

A hardware wallet lets you hold Bitcoin without trusting an exchange. Recommended options:

Coinkite Coldcard (More advanced)

🚨 Security Tip:

Never take a photo of your seed phrase.

Never store it digitally.

Use stainless steel to back up the seed phrase.

2. Multi-Signature Vaults (For Larger Holdings):

For significant holdings, multi-signature (multi-sig) setups offer extra security. Top services:

💡 Multi-sig means multiple keys are needed to move Bitcoin, reducing single points of failure.

Bitcoin's 4-Year Cycle & Market Timing

Bitcoin follows a predictable 4-year halving cycle, where new supply is cut in half. Historically, Bitcoin’s price peaks 12-18 months after each halving:

2013 Peak: ~$1,100 (Halving: 2012)

2017 Peak: ~$20,000 (Halving: 2016)

2021 Peak: ~$69,000 (Halving: 2020)

2025 Peak? 🚀 (Halving: April 2024)

💡 If the pattern holds, late 2025 could be a major price discovery phase.

📢 Bitcoin is long-term, not a get-rich-quick scheme.

Best Bitcoin Books & Learning Resources

📚 Books:

The Big Print – Lawrence Lepard

Why Bitcoin? – Tomer Strolight

The Dao of Bitcoin – Scott Dedels

The Bitcoin Standard – Saifedean Ammous

Broken Money – Lyn Alden

The Creature from Jekyll Island – G. Edward Griffin

🎧 Podcasts & YouTube Channels:

What Bitcoin Did – Peter McCormack & Danny Knowles

What is Money – Robert Breedlove

The Bitcoin Standard Podcast – Saifedean Ammous

BTC Sessions – Bitcoin tutorials

Natalie Brunell – Coin Stories – Macro insights

Final Thoughts

Bitcoin is the most important financial innovation of our lifetime. It’s not just another investment—it’s a fundamentally better form of money.

If you have questions, I’d love to discuss them further!

🚀 Enjoy your journey into Bitcoin!